International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

النسخة 6الرقم المعياري الدولي: 978-0071316972

International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

النسخة 6الرقم المعياري الدولي: 978-0071316972 تمرين 18

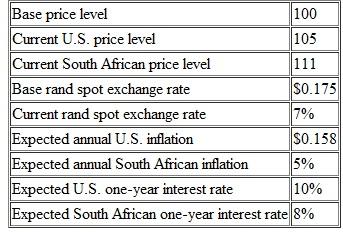

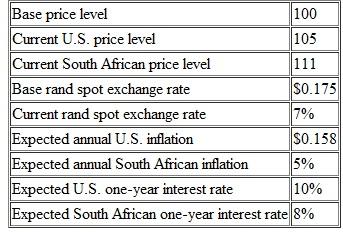

(CFA question) Omni Advisors, an international pension fund manager, uses the concepts of purchasing power parity (PPP) and the International Fisher Effect (IFE) to forecast spot exchange rates. Omni gathers the financial information as follows:  Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).

a. The current ZAR spot rate in USD that would have been forecast by PPP.

b. Using the IFE, the expected ZAR spot rate in USD one year from now.

c. Using PPP, the expected ZAR spot rate in USD four years from now.

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).

Calculate the following exchange rates (ZAR and USD refer to the South African rand and U.S. dollar, respectively).a. The current ZAR spot rate in USD that would have been forecast by PPP.

b. Using the IFE, the expected ZAR spot rate in USD one year from now.

c. Using PPP, the expected ZAR spot rate in USD four years from now.

التوضيح

Following is the information provided: ...

International Financial Management 6th Edition by Sanjiv Eun, Cheol Resnick, Bruce Sabherwal

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255