McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 71

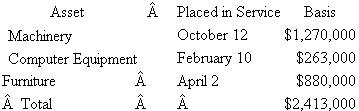

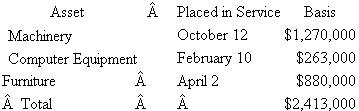

Assume that TDW Corporation (calendar year end) has 2011 taxable income of $650,000 before the §179 expense (assume no bonus depreciation), acquired the following assets during 2011:

a) What is the maximum amount of §179 expense TDW may deduct for 2011

a) What is the maximum amount of §179 expense TDW may deduct for 2011

b) What is the maximum total depreciation expense, including §179 expense, that TDW may deduct in 2011 on the assets it placed in service in 2011

a) What is the maximum amount of §179 expense TDW may deduct for 2011

a) What is the maximum amount of §179 expense TDW may deduct for 2011 b) What is the maximum total depreciation expense, including §179 expense, that TDW may deduct in 2011 on the assets it placed in service in 2011

التوضيح

Depreciation (MACRS rules)

Depreciation ...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255