McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 65

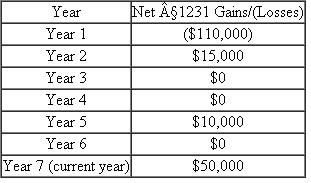

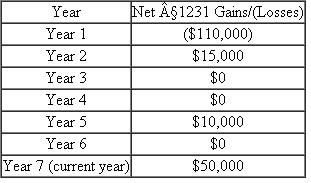

Han runs a sole proprietorship. Hans reported the following net §1231 gains and losses since he began business:

a. What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income

a. What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income

b. Assume, that the $50,000 net §1231 gain occurs in year 6 instead of year 7. What amount of the gain would be treated as ordinary income in year 6

a. What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income

a. What amount, if any, of the year 7 (current year) $50,000 net §1231 gain is treated as ordinary income b. Assume, that the $50,000 net §1231 gain occurs in year 6 instead of year 7. What amount of the gain would be treated as ordinary income in year 6

التوضيح

a.After applying the §1231 fiv...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255