McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 5

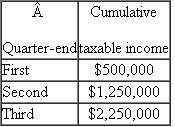

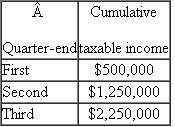

{Planning} Last year, JL Corporation's tax liability was $900,000. For the current year, JL Corporation reported the following taxable income at the end of its first, second, and third quarters (see table below). What are JL's minimum required first, second, third, and fourth quarter estimated tax payments (ignore the actual current year tax safe harbor)

التوضيح

Annual income method

This is most simpl...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255