McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 51

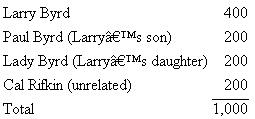

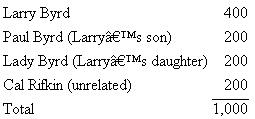

Oriole Corporation, a privately held company, has one class of voting common stock, of which 1,000 shares are issued and outstanding. The shares are owned as follows:

Larry is considering retirement and would like to have the corporation redeem all of his shares for $400,000.

Larry is considering retirement and would like to have the corporation redeem all of his shares for $400,000.

a. What must Larry do or consider if he wants to guarantee that the redemption will be treated as an exchange

b. Could Larry act as a consultant to the company and still have the redemption treated as an exchange

Larry is considering retirement and would like to have the corporation redeem all of his shares for $400,000.

Larry is considering retirement and would like to have the corporation redeem all of his shares for $400,000.a. What must Larry do or consider if he wants to guarantee that the redemption will be treated as an exchange

b. Could Larry act as a consultant to the company and still have the redemption treated as an exchange

التوضيح

Dividend means distribution of property ...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255