McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 19

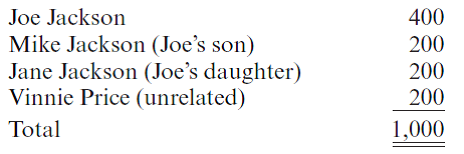

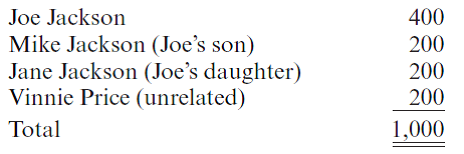

Thriller Corporation has one class of voting common stock, of which 1,000 shares are issued and outstanding. The shares are owned as follows:

Thriller Corporation has current E P of $300,000 for 2011 and accumulated

E P at January 1, 2011, of $500,000.

During 2011, the corporation made the following distributions to its shareholders:

03/31: Paid a dividend of $10 per share to each shareholder ($10,000 in total).

06/30: Redeemed 200 shares of Joe's stock for $200,000. Joe's basis in the 200 shares redeemed was $100,000.

09/30: Redeemed 60 shares of Vinnie's stock for $60,000. His basis in the 60 shares was $36,000.

12/31: Paid a dividend of $10/share to each shareholder ($7,400 in total).

Required:

a. Determine the tax status of each distribution made during 2011. ( Hint: First, consider if the redemptions are treated as dividend distributions or exchanges.)

b. Compute the corporation's accumulated E P at January 1, 2012.c. Joe is considering retirement and would like to have the corporation redeem all of his shares for $100,000 plus a 10-year note with a fair market value of $300,000.

1. What must Joe do or consider if he wants to ensure that the redemption will be treated as an exchange

2. Could Joe still act as a consultant to the company

d. Thriller Corporation must pay attorney's fees of $5,000 to facilitate the stock redemptions. Is this fee deductible

Thriller Corporation has current E P of $300,000 for 2011 and accumulated

E P at January 1, 2011, of $500,000.

During 2011, the corporation made the following distributions to its shareholders:

03/31: Paid a dividend of $10 per share to each shareholder ($10,000 in total).

06/30: Redeemed 200 shares of Joe's stock for $200,000. Joe's basis in the 200 shares redeemed was $100,000.

09/30: Redeemed 60 shares of Vinnie's stock for $60,000. His basis in the 60 shares was $36,000.

12/31: Paid a dividend of $10/share to each shareholder ($7,400 in total).

Required:

a. Determine the tax status of each distribution made during 2011. ( Hint: First, consider if the redemptions are treated as dividend distributions or exchanges.)

b. Compute the corporation's accumulated E P at January 1, 2012.c. Joe is considering retirement and would like to have the corporation redeem all of his shares for $100,000 plus a 10-year note with a fair market value of $300,000.

1. What must Joe do or consider if he wants to ensure that the redemption will be treated as an exchange

2. Could Joe still act as a consultant to the company

d. Thriller Corporation must pay attorney's fees of $5,000 to facilitate the stock redemptions. Is this fee deductible

التوضيح

a.Determine the tax status of each distr...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255