McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 27

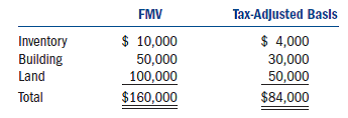

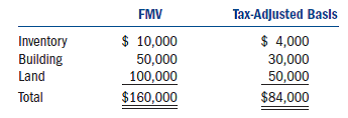

Ramon incorporated his sole proprietorship by transferring inventory, a building, and land to the corporation in return for 100 percent of the corporation's stock. The property transferred to the corporation had the following fair market values and tax-adjusted bases:

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Ramon.

a. What amount of gain or loss does Ramon realize on the transfer of the property to his corporation

b. What amount of gain or loss does Ramon recognize on the transfer of the property to his corporation

c. What is Ramon's basis in the stock he receives in his corporation

The fair market value of the corporation's stock received in the exchange equaled the fair market value of the assets transferred to the corporation by Ramon.

a. What amount of gain or loss does Ramon realize on the transfer of the property to his corporation

b. What amount of gain or loss does Ramon recognize on the transfer of the property to his corporation

c. What is Ramon's basis in the stock he receives in his corporation

التوضيح

Sole proprietorship:

The sole proprieto...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255