McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 44

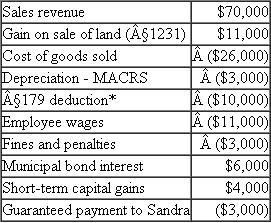

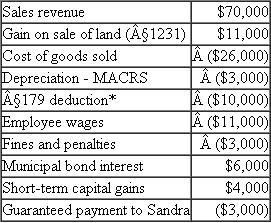

Georgio owns a 20 percent profits and capital interest in Rain Tree LLC. For the current year, Rain Tree had the following revenues, expenses, gains, and losses:

*Assume the §179 property placed in service limitation does not apply.

a. How much ordinary business income (loss) is allocated to Georgio for the year

b. What are Georgio's separately stated items for the year

*Assume the §179 property placed in service limitation does not apply.

a. How much ordinary business income (loss) is allocated to Georgio for the year

b. What are Georgio's separately stated items for the year

التوضيح

Partnership Interest:

Partnership inter...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255