McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

النسخة 3الرقم المعياري الدولي: 9780077924522 تمرين 63

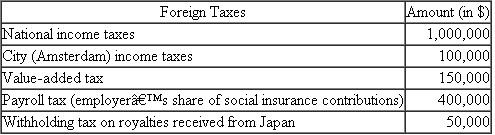

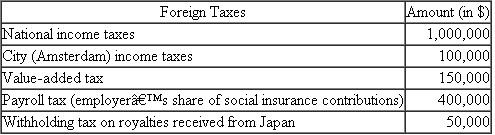

Gameco, a U.S. corporation, operates gambling machines in the United States and abroad. Gameco conducts its operations in Europe through a Dutch B.V., which is treated as a branch for U.S. tax purposes. Gameco also licenses game machines to an unrelated company in Japan. During the current year, Gameco paid the following foreign taxes, translated into U.S. dollars at the appropriate exchange rate:

Identify Gameco's creditable foreign taxes.

Identify Gameco's creditable foreign taxes.

Identify Gameco's creditable foreign taxes.

Identify Gameco's creditable foreign taxes.التوضيح

Inbound and outbound transaction

An out...

McGraw-Hill's Taxation of Business Entities 3rd Edition by Connie Weaver, Brian Spilker, Edmund Outslay, John Robinson, Ronald Worsham, Benjamin Ayers, John Barrick

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255