Basics of Engineering Economy 1st Edition by Leland Blank,Anthony Tarquin

النسخة 1الرقم المعياري الدولي: 9780073401294

Basics of Engineering Economy 1st Edition by Leland Blank,Anthony Tarquin

النسخة 1الرقم المعياري الدولي: 9780073401294 تمرين 7

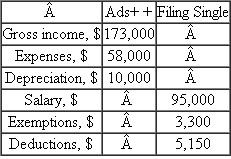

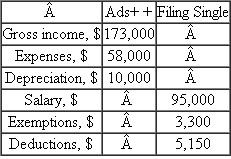

CJ operates Ads + +, a legally registered Internet ad business.Assume he can file his federal income tax return as a small corporation or as a single individual.The GI of $73,000 is for Ads + + as a corporation, while the $5,000 salary is the amount CJ paid himself.(The excess of $0,000 between GI - E = $15,000 and CJ's salary is called retained earnings for Ads + +.Appendix B describes accounting reports.)

CJ estimates an effective federal tax rate of T e = 25% regardless of the method used to calculate taxes.For both methods of filing, determine (a) the estimated taxes using T e and ( b ) taxes using the tax rate tables.Which method results in lower taxes for CJ?

CJ estimates an effective federal tax rate of T e = 25% regardless of the method used to calculate taxes.For both methods of filing, determine (a) the estimated taxes using T e and ( b ) taxes using the tax rate tables.Which method results in lower taxes for CJ?

التوضيح

Taxable income for corporation is determ...

Basics of Engineering Economy 1st Edition by Leland Blank,Anthony Tarquin

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255