Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

النسخة 5الرقم المعياري الدولي: 978-0073375779

Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

النسخة 5الرقم المعياري الدولي: 978-0073375779 تمرين 5

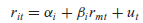

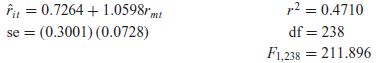

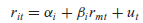

What is known as the characteristic line of modern investment analysis is simply the regression line obtained from the following model:

where r it = the rate of return on the ith security in time t

r mt = the rate of return on the market portfolio in time t

u t = stochastic disturbance term

In this model i is known as the beta coefficient of the ith security, a measure of market (or systematic) risk of a security.*

*See Haim Levy and Marshall Sarnat, Portfolio and Investment Selection: Theory and Practice, Prentice Hall International, Englewood Cliffs, NJ, 1984, Chap. 12.

On the basis of 240 monthly rates of return for the period 1956-1976, Fogler and Ganapathy obtained the following characteristic line for IBM stock in relation to the market portfolio index developed at the University of Chicago:*

a. A security whose beta coefficient is greater than one is said to be a volatile or aggressive security. Was IBM a volatile security in the time period under study

b. Is the intercept coefficient significantly different from zero If it is, what is its practical meaning

*H. Russell Fogler and Sundaram Ganapathy, Financial Econometrics, Prentice Hall, Englewood Cliffs, NJ, 1982, p. 13.

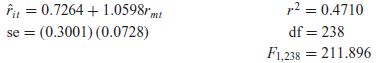

where r it = the rate of return on the ith security in time t

r mt = the rate of return on the market portfolio in time t

u t = stochastic disturbance term

In this model i is known as the beta coefficient of the ith security, a measure of market (or systematic) risk of a security.*

*See Haim Levy and Marshall Sarnat, Portfolio and Investment Selection: Theory and Practice, Prentice Hall International, Englewood Cliffs, NJ, 1984, Chap. 12.

On the basis of 240 monthly rates of return for the period 1956-1976, Fogler and Ganapathy obtained the following characteristic line for IBM stock in relation to the market portfolio index developed at the University of Chicago:*

a. A security whose beta coefficient is greater than one is said to be a volatile or aggressive security. Was IBM a volatile security in the time period under study

b. Is the intercept coefficient significantly different from zero If it is, what is its practical meaning

*H. Russell Fogler and Sundaram Ganapathy, Financial Econometrics, Prentice Hall, Englewood Cliffs, NJ, 1982, p. 13.

التوضيح

The objective of the following analysis ...

Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255