Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

النسخة 5الرقم المعياري الدولي: 978-0073375779

Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

النسخة 5الرقم المعياري الدولي: 978-0073375779 تمرين 2

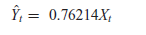

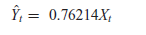

The following regression results were based on monthly data over the period January 1978 to December 1987:

Se=(0.02596) (0.27009)

t =(0.26229) (2.80700)

P value=(0.7984) (0.0186) r 2 = 0.4406

Se=(0.265799)

T =(2.95408)

P value=(0.0131)r 2 =0.43684

where Y = monthly rate of return on Texaco common stock, %, and X= monthly market rate of return,%. *

a. What is the difference between the two regression models

b. Given the preceding results, would you retain the intercept term in the first model Why or why not

c. How would you interpret the slope coefficients in the two models

d. What is the theory underlying the two models

e. Can you compare the r 2 terms of the two models Why or why not

f. The Jarque-Bera normality statistic for the first model in this problem is 1.1167 and for the second model it is 1.1170. What conclusions can you draw from these statistics

g. The t value of the slope coefficient in the zero intercept model is about 2.95, whereas that with the intercept present is about 2.81. Can you rationalize this result

Se=(0.02596) (0.27009)

t =(0.26229) (2.80700)

P value=(0.7984) (0.0186) r 2 = 0.4406

Se=(0.265799)

T =(2.95408)

P value=(0.0131)r 2 =0.43684

where Y = monthly rate of return on Texaco common stock, %, and X= monthly market rate of return,%. *

a. What is the difference between the two regression models

b. Given the preceding results, would you retain the intercept term in the first model Why or why not

c. How would you interpret the slope coefficients in the two models

d. What is the theory underlying the two models

e. Can you compare the r 2 terms of the two models Why or why not

f. The Jarque-Bera normality statistic for the first model in this problem is 1.1167 and for the second model it is 1.1170. What conclusions can you draw from these statistics

g. The t value of the slope coefficient in the zero intercept model is about 2.95, whereas that with the intercept present is about 2.81. Can you rationalize this result

التوضيح

The objective of the following analysis ...

Basic Econometrics 5th Edition by Damodar Gujarati,Dawn Porter

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255