McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 23

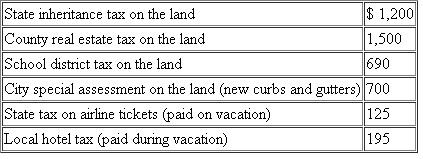

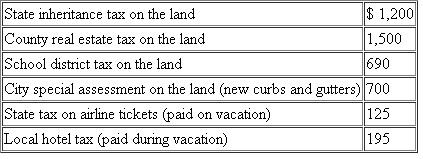

Charles has AGI of $50,000 and has made the following payments related to (1) land he inherited from his deceased aunt and (2) a personal vacation taken last year.Calculate the amount of taxes Charles may include in his itemized deductions for the year under the following circumstances  a.Suppose that Charles holds the land for appreciation.b.Suppose that Charles holds the land for rent.c.Suppose that the vacation was actually a business trip for his employer.:

a.Suppose that Charles holds the land for appreciation.b.Suppose that Charles holds the land for rent.c.Suppose that the vacation was actually a business trip for his employer.:

a.Suppose that Charles holds the land for appreciation.b.Suppose that Charles holds the land for rent.c.Suppose that the vacation was actually a business trip for his employer.:

a.Suppose that Charles holds the land for appreciation.b.Suppose that Charles holds the land for rent.c.Suppose that the vacation was actually a business trip for his employer.:التوضيح

Itemized deductions:

Itemized deduction...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255