McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 16

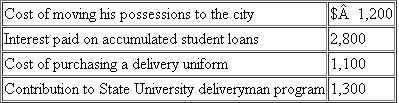

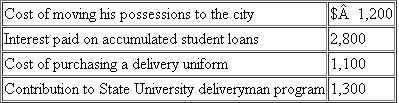

Evan graduated form college,and took a job as a deliveryman in the city.Evan was paid a salary of $63,00 and he received $700 in hourly pay for part-time work over the weekends.Evan summarized his expenses below.  Calculate Evan's AGI and taxable income if he files single with one personal exemption.

Calculate Evan's AGI and taxable income if he files single with one personal exemption.

Calculate Evan's AGI and taxable income if he files single with one personal exemption.

Calculate Evan's AGI and taxable income if he files single with one personal exemption.التوضيح

Adjusted gross income and taxable income...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255