McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 11

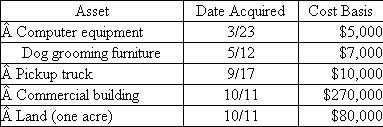

At the beginning of the year, Poplock began a calendar-year dog boarding business called Griff's Palace.Poplock bought and placed in service the following assets during the year:  Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

What is Poplock's year 1 depreciation expense for each asset? What is Poplock's year 2 depreciation expense for each asset?

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:

Assuming Poplock does not elect §179 expensing or bonus depreciation, answer the following questions:What is Poplock's year 1 depreciation expense for each asset? What is Poplock's year 2 depreciation expense for each asset?

التوضيح

Cost Recovery

The cost of an asset is r...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255