McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 20

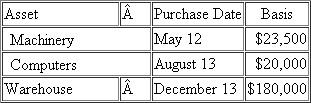

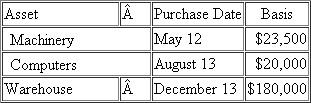

Paul Vote purchased the following assets this year (ignore §179 expensing and bonus depreciation when answering the questions below):  a.What is Paul's allowable MACRS depreciation expense for the property?

a.What is Paul's allowable MACRS depreciation expense for the property?

b.What is Paul's allowable alternative minimum tax (AMT) depreciation expense for the property? You will need to find the AMT depreciation tables to compute the depreciation.

a.What is Paul's allowable MACRS depreciation expense for the property?

a.What is Paul's allowable MACRS depreciation expense for the property?b.What is Paul's allowable alternative minimum tax (AMT) depreciation expense for the property? You will need to find the AMT depreciation tables to compute the depreciation.

التوضيح

Depreciation conventions

Depreciation c...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255