McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 69

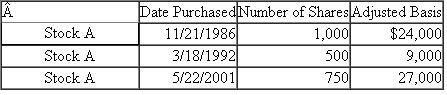

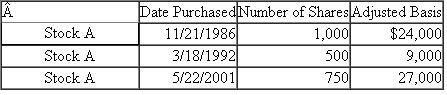

George bought the following amounts of Stock A over the years:  On October 12, 2011, he sold 1,200 of his shares of Stock A for $38 per share.a.How much gain/loss will George have to recognize if he uses the FIFO method of accounting for the shares sold?

On October 12, 2011, he sold 1,200 of his shares of Stock A for $38 per share.a.How much gain/loss will George have to recognize if he uses the FIFO method of accounting for the shares sold?

b.How much gain/loss will George have to recognize if he specifically identifies the shares to be sold by telling his broker to sell all 750 shares from the 5/22/2001 purchase and 450 shares from the 11/21/1986 purchase?

On October 12, 2011, he sold 1,200 of his shares of Stock A for $38 per share.a.How much gain/loss will George have to recognize if he uses the FIFO method of accounting for the shares sold?

On October 12, 2011, he sold 1,200 of his shares of Stock A for $38 per share.a.How much gain/loss will George have to recognize if he uses the FIFO method of accounting for the shares sold?b.How much gain/loss will George have to recognize if he specifically identifies the shares to be sold by telling his broker to sell all 750 shares from the 5/22/2001 purchase and 450 shares from the 11/21/1986 purchase?

التوضيح

Capital gains and losses

When investors...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255