McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 74

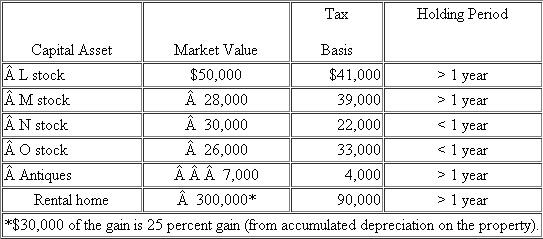

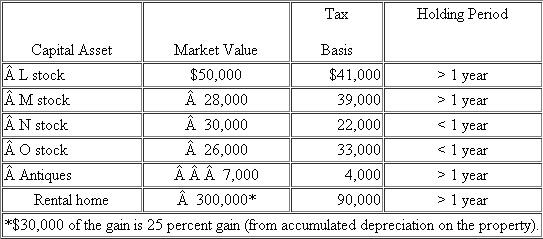

During the current year, Ron and Anne sold the following assets:  a.Given that Ron and Anne have taxable income of only $20,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2011 assuming they file a joint return?

a.Given that Ron and Anne have taxable income of only $20,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2011 assuming they file a joint return?

b.Given that Ron and Anne have taxable income of $150,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2011 assuming they file a joint return?

a.Given that Ron and Anne have taxable income of only $20,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2011 assuming they file a joint return?

a.Given that Ron and Anne have taxable income of only $20,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2011 assuming they file a joint return?b.Given that Ron and Anne have taxable income of $150,000 (all ordinary) before considering the tax effect of their asset sales, what is their gross tax liability for 2011 assuming they file a joint return?

التوضيح

Gross Tax Liability:

The amount calcula...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255