McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 18

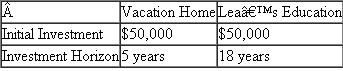

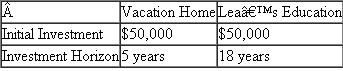

{Planning} As noted in the chapter, Nick inherited $100,000 with the stipulation that he "invest it to financially benefit his family. Nick and Rachel decided they would invest the inheritance to help them accomplish two financial goals: purchasing a Park City vacation home and saving for Lea's education.  The Suttons have a marginal income tax rate of 30 percent (capital gains rate of 15 percent), and have decided to investigate the following investment opportunities.

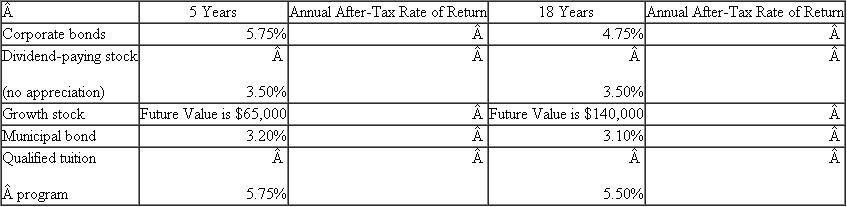

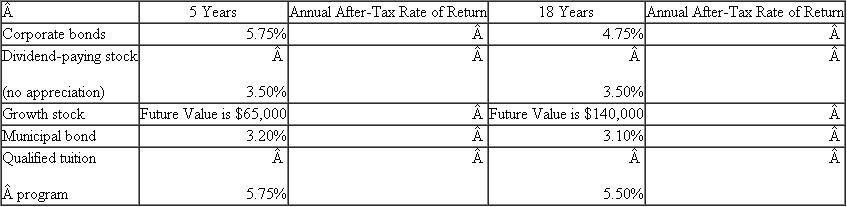

The Suttons have a marginal income tax rate of 30 percent (capital gains rate of 15 percent), and have decided to investigate the following investment opportunities.  Complete the two annual after-tax rates of return columns for each investment and provide investment recommendations for the Suttons.

Complete the two annual after-tax rates of return columns for each investment and provide investment recommendations for the Suttons.

The Suttons have a marginal income tax rate of 30 percent (capital gains rate of 15 percent), and have decided to investigate the following investment opportunities.

The Suttons have a marginal income tax rate of 30 percent (capital gains rate of 15 percent), and have decided to investigate the following investment opportunities.  Complete the two annual after-tax rates of return columns for each investment and provide investment recommendations for the Suttons.

Complete the two annual after-tax rates of return columns for each investment and provide investment recommendations for the Suttons.التوضيح

Considering after-tax rates of return al...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255