McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 80

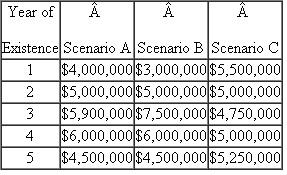

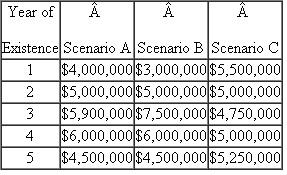

ELS corporation is about to begin its sixth year of existence.Assume that ELS reported gross receipts for each of its first five years of existence for scenarios A, B, and C as follows:  a.In what years is ELS allowed to use the cash method of accouting under Scenario A?

a.In what years is ELS allowed to use the cash method of accouting under Scenario A?

b.In what years is ELS allowed to use the cash method of accouting under Scenario B?

c.In what years is ELS allowed to use the cash method of accouting under Scenario C?

a.In what years is ELS allowed to use the cash method of accouting under Scenario A?

a.In what years is ELS allowed to use the cash method of accouting under Scenario A?b.In what years is ELS allowed to use the cash method of accouting under Scenario B?

c.In what years is ELS allowed to use the cash method of accouting under Scenario C?

التوضيح

ELS Corporation is allowed to cash metho...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255