McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 33

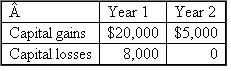

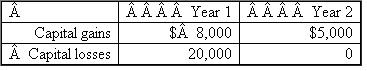

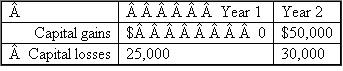

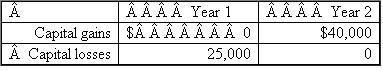

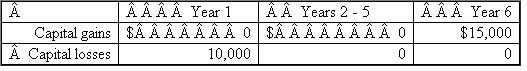

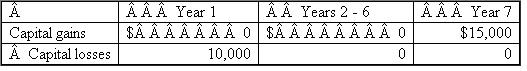

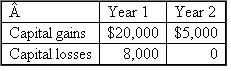

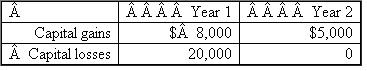

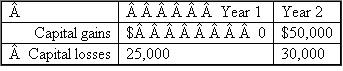

What book-tax differences in year 1 and year 2 associated with its capital gains and losses would ABD Inc.report in the following alternative scenarios? Identify each book-tax difference as favorable or unfavorable and as permanent or temporary.a.?  b.

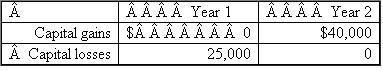

b.  c.

c.  d.

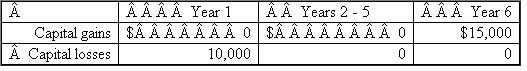

d.  e.Answer for year 6 only.

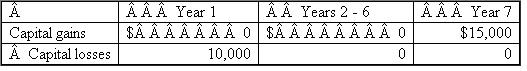

e.Answer for year 6 only.  f.Answer for year 7 only.

f.Answer for year 7 only.

b.

b.  c.

c.  d.

d.  e.Answer for year 6 only.

e.Answer for year 6 only.  f.Answer for year 7 only.

f.Answer for year 7 only.

التوضيح

The book tax differences of the organiza...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255