McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 52

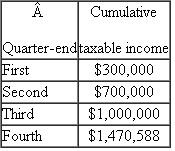

Last year, Cougar Corp.(CC) reported a net operating loss of $25,000.In the current year, CC expected its current year tax liability to be $440,000 so it made four equal estimated tax payments of $110,000 each.Cougar closed its books at the end of each quarter.The following schedule reports CC's taxable income at the end of each quarter:  CC's current year tax liability on $1,470,588 of taxable income is $480,000.Does CC owe underpayment penalties on its estimated tax payments? If so, for which quarters does it owe the penalty?

CC's current year tax liability on $1,470,588 of taxable income is $480,000.Does CC owe underpayment penalties on its estimated tax payments? If so, for which quarters does it owe the penalty?

CC's current year tax liability on $1,470,588 of taxable income is $480,000.Does CC owe underpayment penalties on its estimated tax payments? If so, for which quarters does it owe the penalty?

CC's current year tax liability on $1,470,588 of taxable income is $480,000.Does CC owe underpayment penalties on its estimated tax payments? If so, for which quarters does it owe the penalty?التوضيح

The tax liability of the organization ca...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255