McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 41

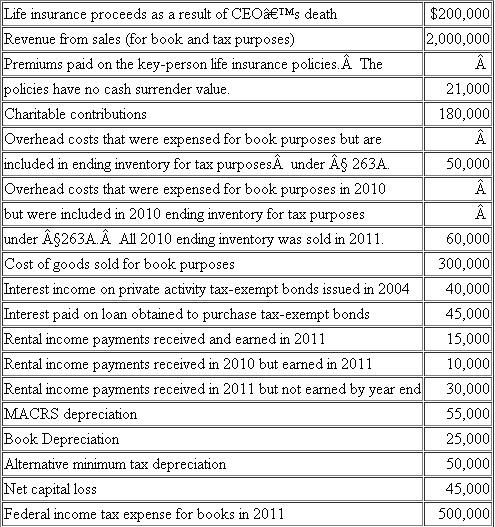

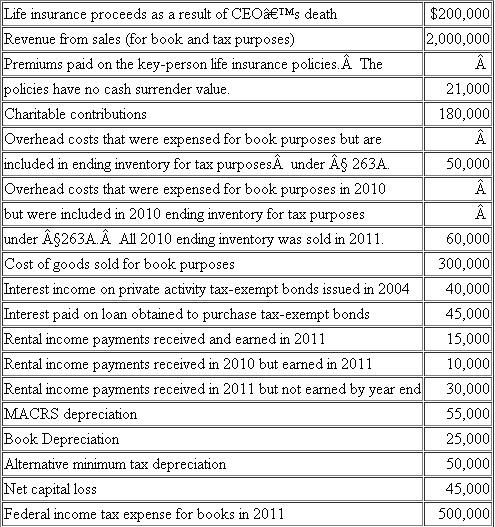

Timpanogos Inc.is an accrual-method calendar-year corporation.For 2011, it reported financial statement income after taxes of $1,149,000.Timpanogos provided the following information relating to its 2011 activities:  Timpanogos did not qualify for the domestic production activities deduction.Required:

Timpanogos did not qualify for the domestic production activities deduction.Required:

a.Reconcile book income to taxable income for Timpanogos Inc.Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income.b.Identify each book-tax difference as either permanent or temporary.c.Complete Schedule M-1 for Timpanogos.d.Compute Timpanogos's regular tax liability for 2011.e.Determine Timpanogos's alternative minimum tax, if any.

Timpanogos did not qualify for the domestic production activities deduction.Required:

Timpanogos did not qualify for the domestic production activities deduction.Required: a.Reconcile book income to taxable income for Timpanogos Inc.Be sure to start with book income and identify all of the adjustments necessary to arrive at taxable income.b.Identify each book-tax difference as either permanent or temporary.c.Complete Schedule M-1 for Timpanogos.d.Compute Timpanogos's regular tax liability for 2011.e.Determine Timpanogos's alternative minimum tax, if any.

التوضيح

a.impanogos's taxable income is $1,512,0...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255