McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 70

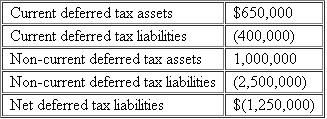

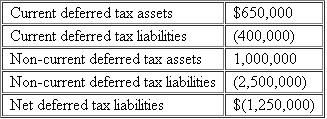

Beacon Corporation recorded the following deferred tax assets and liabilities:  All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U..operations.Which of the following statements describes how Beacon should disclose these accounts on its balance sheet?

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U..operations.Which of the following statements describes how Beacon should disclose these accounts on its balance sheet?

a.Beacon reports a net deferred tax liability of $1,250,000 on its balance sheet

b.Beacon nets the deferred tax assets and the deferred tax liabilities and reports a net deferred tax asset of $1,650,000 and a net deferred tax liability of $2,900,000 on its balance sheet.c.Beacon can elect to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.d.Beacon is required to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U..operations.Which of the following statements describes how Beacon should disclose these accounts on its balance sheet?

All of the deferred tax accounts relate to temporary differences that arose as a result of the company's U..operations.Which of the following statements describes how Beacon should disclose these accounts on its balance sheet?a.Beacon reports a net deferred tax liability of $1,250,000 on its balance sheet

b.Beacon nets the deferred tax assets and the deferred tax liabilities and reports a net deferred tax asset of $1,650,000 and a net deferred tax liability of $2,900,000 on its balance sheet.c.Beacon can elect to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.d.Beacon is required to net the current deferred tax accounts and the non-current tax accounts and report a net current deferred tax asset of $250,000 and a net deferred tax liability of $1,500,000 on its balance sheet.

التوضيح

The current deferred tax accounts and no...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255