McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 30

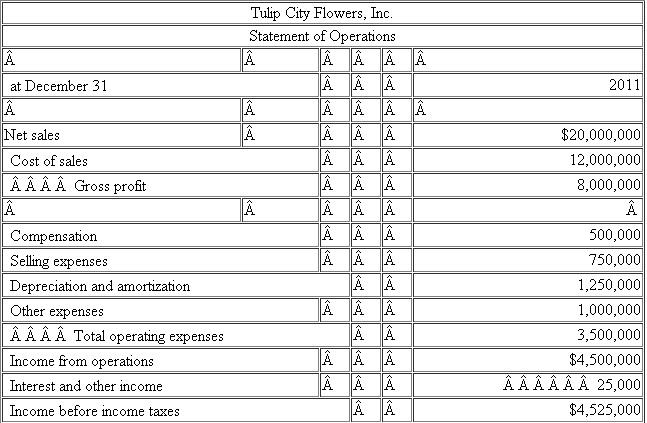

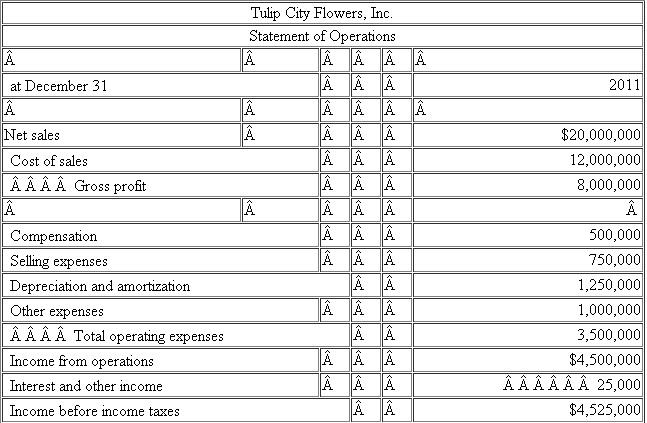

You have been assigned to compute the income tax provision for Tulip City Flowers, Inc.(TCF) as of December 31, 2011.The Company's federal income tax rate is 34%.The Company's Income Statement for 2011 is provided below:  You have identified the following permanent differences:

You have identified the following permanent differences:

Interest income from municipal bonds: $10,000

Nondeductible stock compensation: $5,000

Domestic production activities deduction: $8,000

Nondeductible fines: $1,000

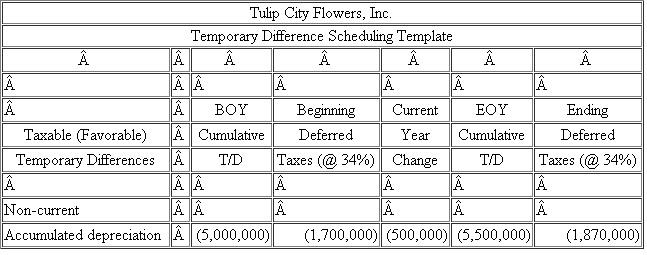

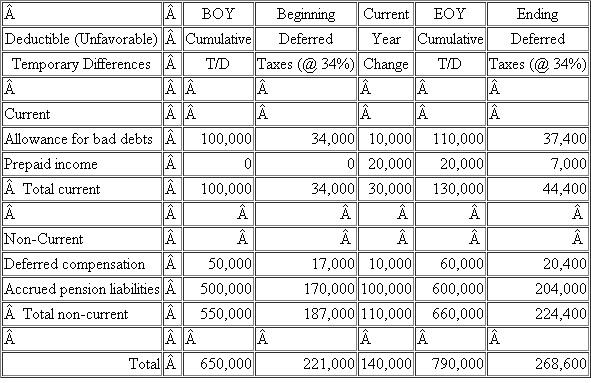

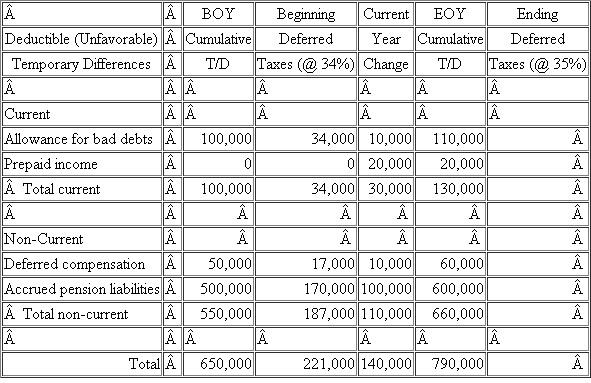

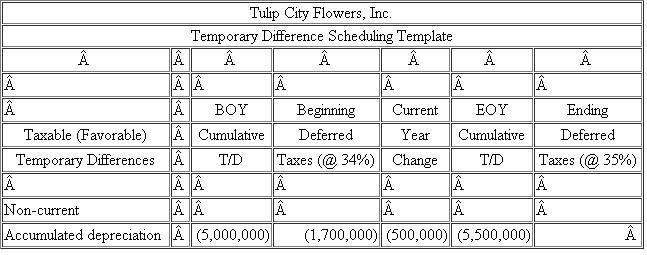

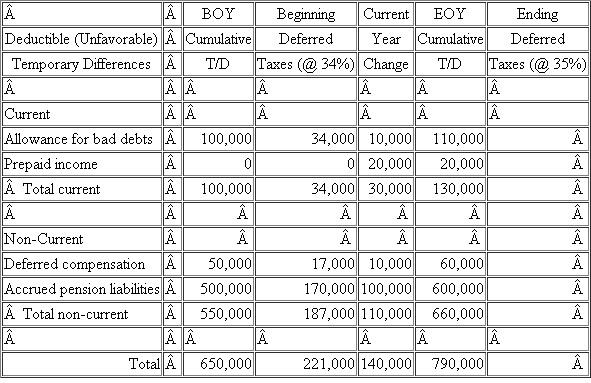

TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

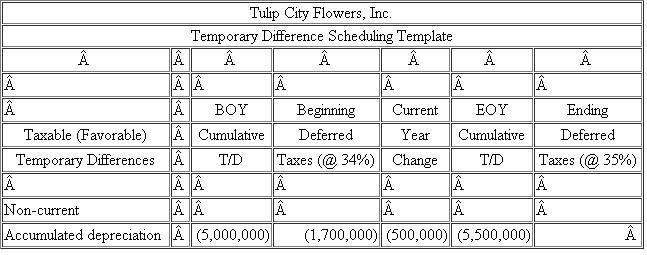

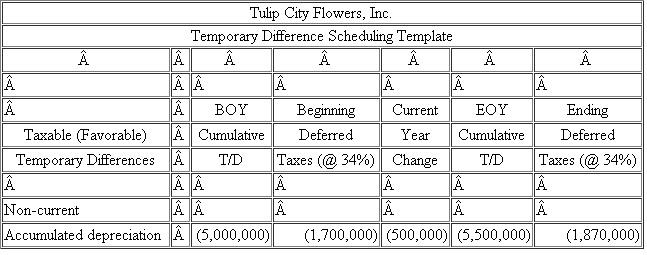

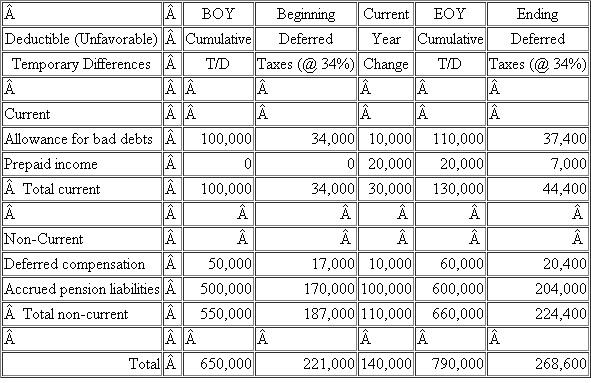

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

You have identified the following permanent differences:

You have identified the following permanent differences:Interest income from municipal bonds: $10,000

Nondeductible stock compensation: $5,000

Domestic production activities deduction: $8,000

Nondeductible fines: $1,000

TCF prepared the following schedule of temporary differences from the beginning of the year to the end of the year:

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

a.Compute TCF's current income tax expense or benefit for 2011.b.Compute TCF's deferred income tax expense or benefit for 2011.c.Prepare a reconciliation of TCF's total income tax provision with its hypothetical income tax expense in both dollars and rates.d.Assume TCF's tax rate increased to 35% in 2011.Recompute TCF's deferred income tax expense or benefit for 2011 using the following template:

التوضيح

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255