McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 9

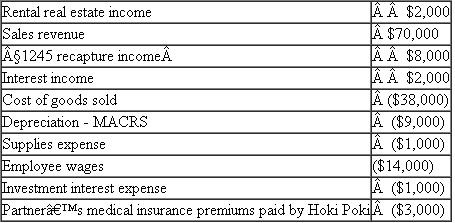

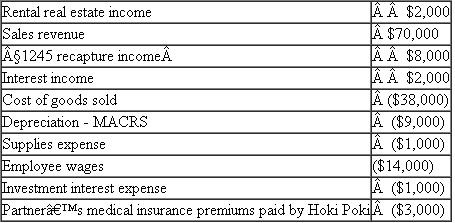

{Research} Hoki Poki, a cash-method general partnership, recorded the following items for its current tax year  As part of preparing Hoki Poki's current year return, identify the items that should be included in computing its ordinary business income (loss) and those that should be separately stated.{ Hint: See Schedule K-1 and related preparer's instructions at www.rs.ov.

As part of preparing Hoki Poki's current year return, identify the items that should be included in computing its ordinary business income (loss) and those that should be separately stated.{ Hint: See Schedule K-1 and related preparer's instructions at www.rs.ov.

As part of preparing Hoki Poki's current year return, identify the items that should be included in computing its ordinary business income (loss) and those that should be separately stated.{ Hint: See Schedule K-1 and related preparer's instructions at www.rs.ov.

As part of preparing Hoki Poki's current year return, identify the items that should be included in computing its ordinary business income (loss) and those that should be separately stated.{ Hint: See Schedule K-1 and related preparer's instructions at www.rs.ov.التوضيح

In the current scenario of Hoki Poki, be...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255