McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 21

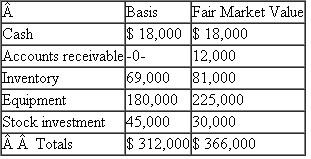

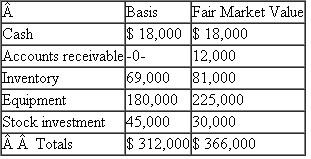

Franklin, Jefferson, and Washington formed the Independence Partnership (a calendar-year-end) by contributing cash 10 years ago.Each partner owns an equal interest in the partnership.Franklin, Jefferson, and Washington each have an outside basis in his partnership interest of $104,000.On January 1 of the current year, Franklin sells his partnership interest to Adams for a cash payment of $122,000.The partnership has the following assets and no liabilities as of the sale date:  The equipment was purchased for $240,000 and the partnership has taken $60,000 of depreciation.The stock was purchased 7 years ago.a.What is Franklin's overall gain or loss on the sale of his partnership interest?

The equipment was purchased for $240,000 and the partnership has taken $60,000 of depreciation.The stock was purchased 7 years ago.a.What is Franklin's overall gain or loss on the sale of his partnership interest?

b.What is the character of Franklin's gain or loss?

The equipment was purchased for $240,000 and the partnership has taken $60,000 of depreciation.The stock was purchased 7 years ago.a.What is Franklin's overall gain or loss on the sale of his partnership interest?

The equipment was purchased for $240,000 and the partnership has taken $60,000 of depreciation.The stock was purchased 7 years ago.a.What is Franklin's overall gain or loss on the sale of his partnership interest?b.What is the character of Franklin's gain or loss?

التوضيح

In the current scenario of I Partnership...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255