McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 25

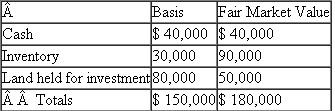

Travis and Alix Weber are equal partners in the Tralix partnership, which does not have a §754 election in place.Alix sells one-half of her interest (25%) to Michael Tomei for $30,000 cash.Just before the sale, Alix's basis in her entire partnership interest is $75,000 including her $30,000 share of the partnership liabilities.Tralix's assets on the sale date are as follows  a.What is the amount and character of Alix's recognized gain or loss on the sale?

a.What is the amount and character of Alix's recognized gain or loss on the sale?

b.What is Alix's basis in her remaining partnership interest?

c.What is Michael's basis in his partnership interest?

d.What is the effect of the sale on the partnership's basis in the assets?

a.What is the amount and character of Alix's recognized gain or loss on the sale?

a.What is the amount and character of Alix's recognized gain or loss on the sale?b.What is Alix's basis in her remaining partnership interest?

c.What is Michael's basis in his partnership interest?

d.What is the effect of the sale on the partnership's basis in the assets?

التوضيح

In the current scenario of T Partnership...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255