McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 37

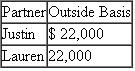

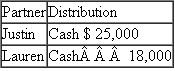

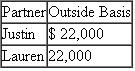

Justin and Lauren are equal partners in the PJenn Partnership.The partners formed the partnership seven years ago by contributing cash.Prior to any distributions, the partners have the following bases in their partnership interests  On December 31 of the current year, the partnership makes a pro-rata operating distribution of:

On December 31 of the current year, the partnership makes a pro-rata operating distribution of:  ?? Property 7,000 ?(FMV) ($2,000 basis to partnership)a.What is the amount and character of Justin's recognized gain or loss?

?? Property 7,000 ?(FMV) ($2,000 basis to partnership)a.What is the amount and character of Justin's recognized gain or loss?

b.What is Justin's remaining basis in his partnership interest?

c.What is the amount and character of Lauren's recognized gain or loss?

d.What is Lauren's basis in the distributed assets?

e.What is Lauren's remaining basis in her partnership interest?

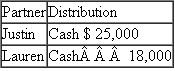

On December 31 of the current year, the partnership makes a pro-rata operating distribution of:

On December 31 of the current year, the partnership makes a pro-rata operating distribution of:  ?? Property 7,000 ?(FMV) ($2,000 basis to partnership)a.What is the amount and character of Justin's recognized gain or loss?

?? Property 7,000 ?(FMV) ($2,000 basis to partnership)a.What is the amount and character of Justin's recognized gain or loss?b.What is Justin's remaining basis in his partnership interest?

c.What is the amount and character of Lauren's recognized gain or loss?

d.What is Lauren's basis in the distributed assets?

e.What is Lauren's remaining basis in her partnership interest?

التوضيح

In the current scenario of PJ Partnershi...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255