McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 34

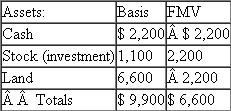

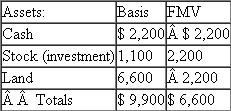

Erin's basis in her Kiybron partnership interest is $3,300.Erin receives a distribution of $2,200 cash from Kiybron in complete liquidation of her interest.Kiybron is an equal partnership with the following balance sheet:  ?Liabilities and capital:

?Liabilities and capital:  ?a.What is the amount and character of Erin's recognized gain or loss? What is the effect on the partnership assets?

?a.What is the amount and character of Erin's recognized gain or loss? What is the effect on the partnership assets?

?b.If Kiybron has a §754 election in place, what is the amount of the special basis adjustment?

?Liabilities and capital:

?Liabilities and capital:  ?a.What is the amount and character of Erin's recognized gain or loss? What is the effect on the partnership assets?

?a.What is the amount and character of Erin's recognized gain or loss? What is the effect on the partnership assets??b.If Kiybron has a §754 election in place, what is the amount of the special basis adjustment?

التوضيح

In the current scenario of K Partneship,...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255