McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 25

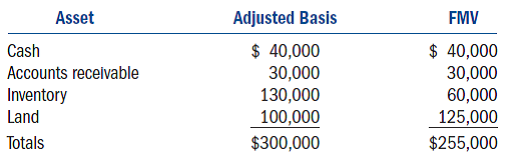

Rivendell Corporation uses the accrual method of accounting and has the following assets as of the end of 2010.Rivendell converted to an S corporation on January 1, 2011.

a.What is Rivendell's net unrealized built-in gain at the time it converted to an S corporation?

b.Assuming the land was valued at $200,000, what would be Rivendell's net unrealized gain at the time it converted to an S corporation?

c.Assuming the original land value but that the inventory was valued at $85,000, what would be Rivendell's net unrealized gain at the time it converted to an S corporation?

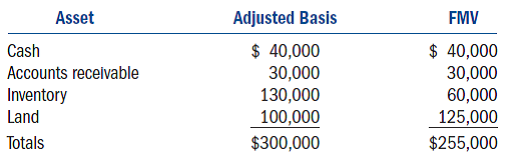

a.What is Rivendell's net unrealized built-in gain at the time it converted to an S corporation?

b.Assuming the land was valued at $200,000, what would be Rivendell's net unrealized gain at the time it converted to an S corporation?

c.Assuming the original land value but that the inventory was valued at $85,000, what would be Rivendell's net unrealized gain at the time it converted to an S corporation?

التوضيح

S corporation

S corporation include lim...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255