McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 8

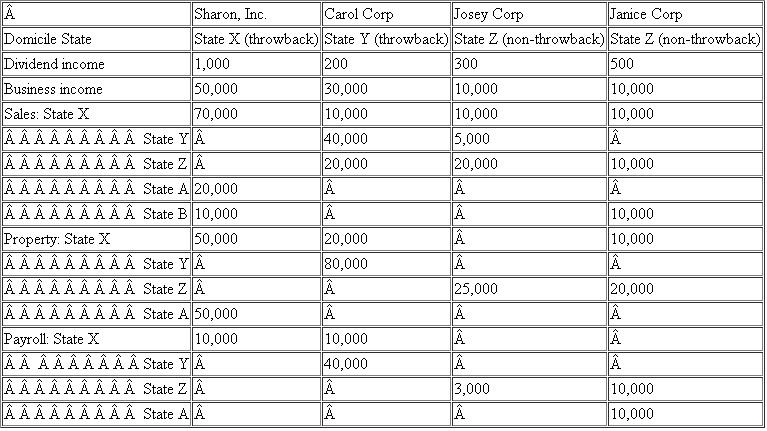

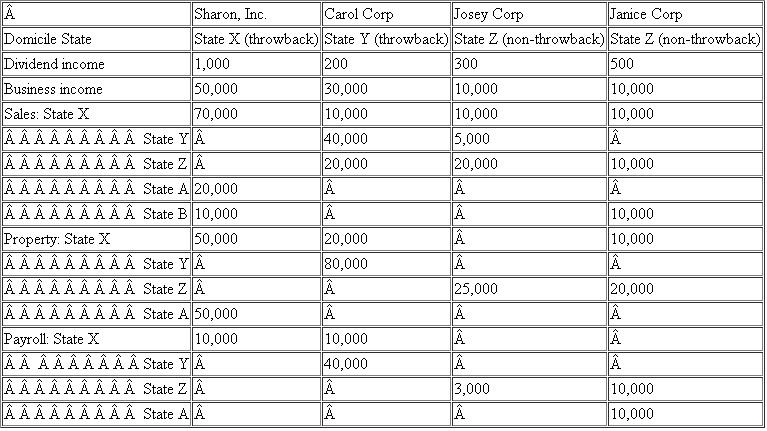

Sharon, Inc.is headquartered in State X, Sharon owns 100% of Carol, Josey and Janice Corps.You can assume that all of the corporations form a single unitary group.You may assume that the sales operations are within the "solicitation" bounds of Public Law 86-272.Each of the corporations has operations in the following states:  Required: Compute the income reported, apportionment factors, and tax liability for State X assuming a tax rate of 15%.

Required: Compute the income reported, apportionment factors, and tax liability for State X assuming a tax rate of 15%.

Required: Compute the income reported, apportionment factors, and tax liability for State X assuming a tax rate of 15%.

Required: Compute the income reported, apportionment factors, and tax liability for State X assuming a tax rate of 15%.التوضيح

Josey has no nexus in State X ...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255