McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

النسخة 3الرقم المعياري الدولي: 9780078111068 تمرين 17

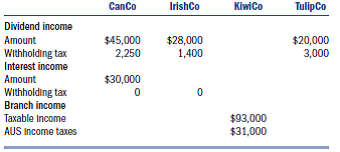

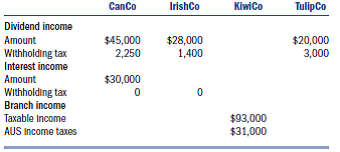

Windmill Corporation manufactures products in its plants in Iowa, Canada, Ireland, and Australia.Windmill conducts its operations in Canada through a 50 percent owned joint venture, CanCo.CanCo is treated as a corporation for U..and Canadian tax purposes.An unrelated Canadian investor owns the remaining 50 percent.Windmill conducts its operations in Ireland through a wholly owned subsidiary, IrishCo.IrishCo is a controlled foreign corporation for U..tax purposes.Windmill conducts its operations in Australia through a wholly owned hybrid entity (KiwiCo) treated as a branch for U..tax purposes and a corporation for Australian tax purposes.Windmill also owns a 5 percent interest in a Dutch corporation (TulipCo).During 2011, Windmill reported the following foreign source income from its international operations and investments.

Notes to the table:

1.CanCo and KiwiCo derive all of their earnings from active business operations.2.The dividend from CanCo carries with it a deemed paid credit (§78 gross-up) of $30,000.3.The dividend from IrishCo carries with it a deemed paid credit (§78 gross-up) of $4,000.a.Classify the income received by Windmill and any associated §78 gross-up into the appropriate FTC baskets.b.Windmill has $1,250,000 of U..source gross income.Windmill also incurred SG A of $300,000 that is apportioned between U..and foreign source income based on the gross income in each basket.Assume KiwiCo's gross income is $93,000.Compute the FTC limitation for each basket of foreign source income.The corporate tax rate is 35 percent.

Notes to the table:

1.CanCo and KiwiCo derive all of their earnings from active business operations.2.The dividend from CanCo carries with it a deemed paid credit (§78 gross-up) of $30,000.3.The dividend from IrishCo carries with it a deemed paid credit (§78 gross-up) of $4,000.a.Classify the income received by Windmill and any associated §78 gross-up into the appropriate FTC baskets.b.Windmill has $1,250,000 of U..source gross income.Windmill also incurred SG A of $300,000 that is apportioned between U..and foreign source income based on the gross income in each basket.Assume KiwiCo's gross income is $93,000.Compute the FTC limitation for each basket of foreign source income.The corporate tax rate is 35 percent.

التوضيح

a.Classify the income received by Windmi...

McGraw-Hill's Taxation of Individuals and Business Entities 3rd Edition by Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255