Principles of Risk Management and Insurance 13th Edition by George Rejda,Michael McNamara

النسخة 13الرقم المعياري الدولي: 978-0134082578

Principles of Risk Management and Insurance 13th Edition by George Rejda,Michael McNamara

النسخة 13الرقم المعياري الدولي: 978-0134082578 تمرين 3

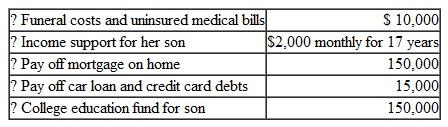

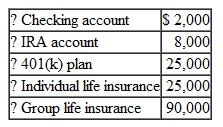

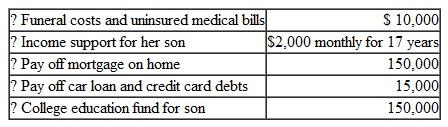

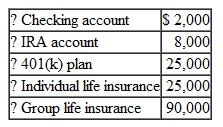

Kelly, age 35, is a single parent and has a one-yearold son. She earns $45,000 annually as a marketing analyst. Her employer provides group life insurance in the amount of twice the employee's salary. Kelly also participates in her employer's 401(k) plan. She has the following financial needs and objectives:

Kelly has the following financial assets:

Kelly has the following financial assets:

a. Ignoring the availability of Social Security survivor benefits, how much additional life insurance, if any, should Kelly purchase to meet her financial goals based on the needs approach? (Assume that the rate of return earned on the policy proceeds is equal to the rate of inflation.)

a. Ignoring the availability of Social Security survivor benefits, how much additional life insurance, if any, should Kelly purchase to meet her financial goals based on the needs approach? (Assume that the rate of return earned on the policy proceeds is equal to the rate of inflation.)

b. How much additional life insurance, if any, is needed if estimated Social Security survivor benefits in the amount of $800 monthly are payable until her son attains age 18?

Kelly has the following financial assets:

Kelly has the following financial assets: a. Ignoring the availability of Social Security survivor benefits, how much additional life insurance, if any, should Kelly purchase to meet her financial goals based on the needs approach? (Assume that the rate of return earned on the policy proceeds is equal to the rate of inflation.)

a. Ignoring the availability of Social Security survivor benefits, how much additional life insurance, if any, should Kelly purchase to meet her financial goals based on the needs approach? (Assume that the rate of return earned on the policy proceeds is equal to the rate of inflation.)b. How much additional life insurance, if any, is needed if estimated Social Security survivor benefits in the amount of $800 monthly are payable until her son attains age 18?

التوضيح

a)Calculate the additional life insuranc...

Principles of Risk Management and Insurance 13th Edition by George Rejda,Michael McNamara

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255