Business 8th Edition by Marianne Jennings

النسخة 8الرقم المعياري الدولي: 978-1285428710

Business 8th Edition by Marianne Jennings

النسخة 8الرقم المعياري الدولي: 978-1285428710 تمرين 11

Escott v BarChris Constr. Corp. 283 F. Supp. 643 (S.D.N.Y. 1968)

Bowling for Fraud Right Up Our Alley

Facts

BarChris was a bowling alley company established in 1946. The bowling industry grew rapidly when automatic pin resetters went on the market in the mid-1950s. BarChris began a program of rapid expansion and in 1960 was responsible for the construction of over 3 percent of all bowling alleys in the United States. BarChris used two methods of financing the construction of these alleys, both of which substantially drained the company's cash flow.

In 1959 BarChris sold approximately one-half million shares of common stock. By I960, its cash flow picture was still troublesome, and it sold debentures. The debenture issue was registered with the SEC, approved, and sold. In spite of the cash boost from the sale, BarChris was still experiencing financial difficulties and declared bankruptcy in October 1962. The debenture holders were not paid their interest; BarChris defaulted.

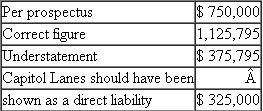

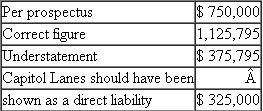

The purchasers of the BarChris debentures brought suit under Section 11 of the 1933 act. They claimed that the registration statement filed by BarChris contained false information and failed to disclose certain material information. Their suit, which centered around the audited financial statements prepared by a CPA firm, claimed that the statements were inaccurate and full of omissions. The following chart summarizes the problems with the financial statements submitted with the registration statements.

Contingent Liabilities as of December 32, I960 , on Alternative Method of Financing

Bowling for Fraud Right Up Our Alley

Facts

BarChris was a bowling alley company established in 1946. The bowling industry grew rapidly when automatic pin resetters went on the market in the mid-1950s. BarChris began a program of rapid expansion and in 1960 was responsible for the construction of over 3 percent of all bowling alleys in the United States. BarChris used two methods of financing the construction of these alleys, both of which substantially drained the company's cash flow.

In 1959 BarChris sold approximately one-half million shares of common stock. By I960, its cash flow picture was still troublesome, and it sold debentures. The debenture issue was registered with the SEC, approved, and sold. In spite of the cash boost from the sale, BarChris was still experiencing financial difficulties and declared bankruptcy in October 1962. The debenture holders were not paid their interest; BarChris defaulted.

The purchasers of the BarChris debentures brought suit under Section 11 of the 1933 act. They claimed that the registration statement filed by BarChris contained false information and failed to disclose certain material information. Their suit, which centered around the audited financial statements prepared by a CPA firm, claimed that the statements were inaccurate and full of omissions. The following chart summarizes the problems with the financial statements submitted with the registration statements.

Contingent Liabilities as of December 32, I960 , on Alternative Method of Financing

التوضيح

BarChris did not pay the interest to the...

Business 8th Edition by Marianne Jennings

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255