Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

النسخة 12الرقم المعياري الدولي: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

النسخة 12الرقم المعياري الدولي: 978-0132605540 تمرين 160

SELF-EMPLOYMENT DEDUCTIONS This problems refer to self-employed individuals. These people pay a Social Security tax of 12.4% and Medicare tax of 2.9%. Find both of the taxes on this annual adjusted earnings. (See Example.)

Ron Morris, a Chic-Filet franchise owner, earned $78,007.14. ___________

EXAMPLE

Finding FICA and Medicare Tax for the Self-Employed

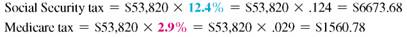

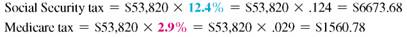

Find the Social Security tax and the Medicare tax paid by Ta Shon Williams, a self-employed Web designer who had adjusted earnings of $53,820 this year.

SOLUTION

Ron Morris, a Chic-Filet franchise owner, earned $78,007.14. ___________

EXAMPLE

Finding FICA and Medicare Tax for the Self-Employed

Find the Social Security tax and the Medicare tax paid by Ta Shon Williams, a self-employed Web designer who had adjusted earnings of $53,820 this year.

SOLUTION

التوضيح

In order to calculate amounts taken for ...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255