Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

النسخة 12الرقم المعياري الدولي: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

النسخة 12الرقم المعياري الدولي: 978-0132605540 تمرين 44

If you were an employer, would you prefer to use the wage bracket method or the percentage method to determine federal withholding tax? Why?

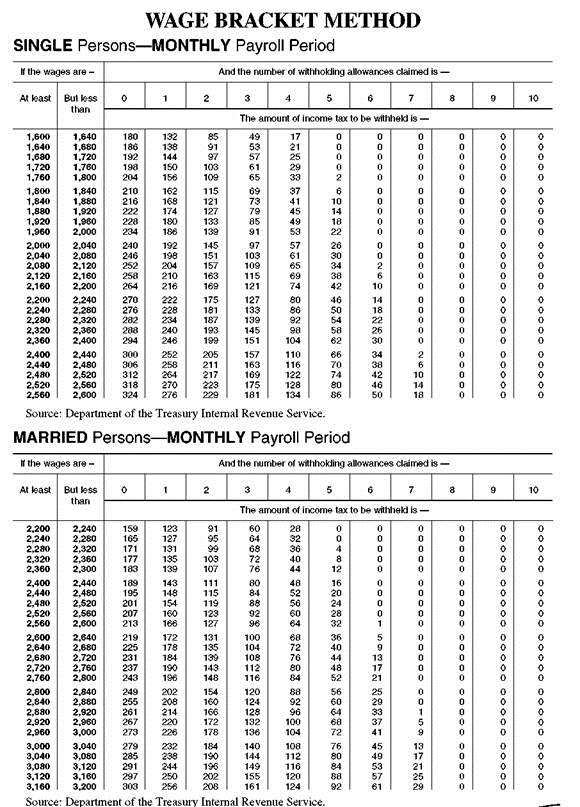

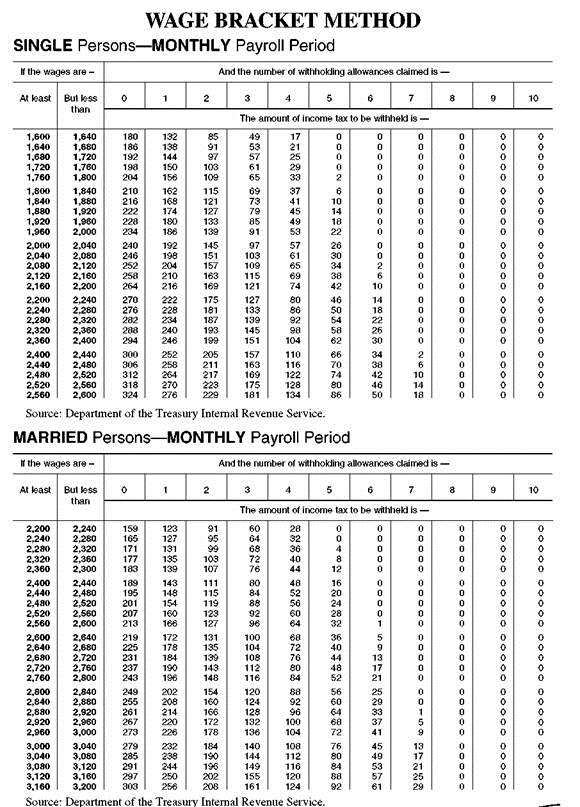

OBJECTIVE Find the federal withholding tax using the wage bracket method. The Internal Revenue Service supplies withholding tax tables to be used with the wage bracket method. These tables are extensive, covering weekly, biweekly, semimonthly, monthly, and daily pay periods. Samples of the withholding tables are shown on this page and the next page.

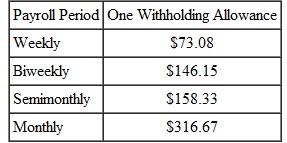

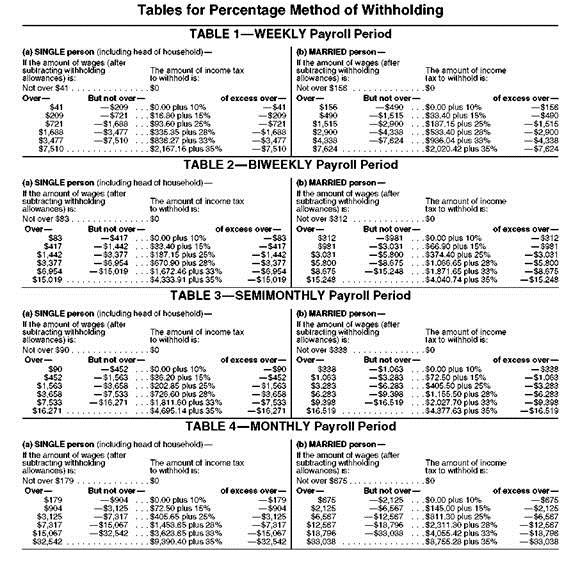

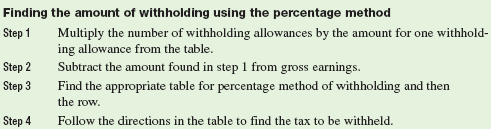

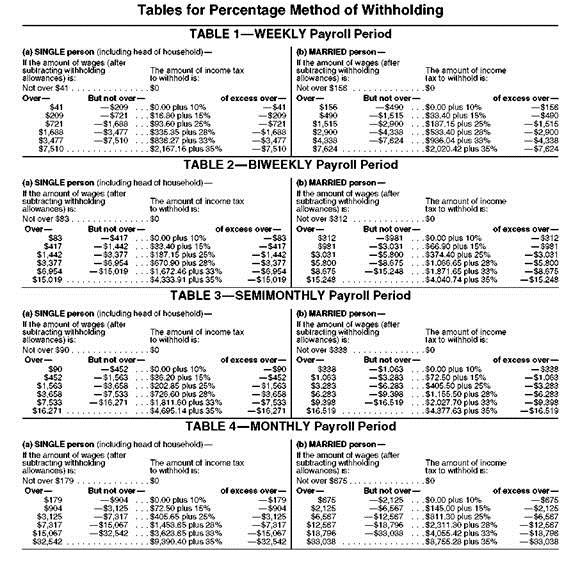

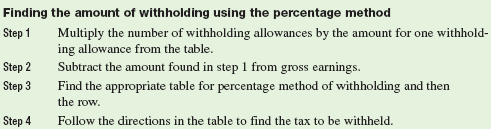

OBJECTIVE Find the federal withholding tax using the percentage method. Many companies today prefer to use the percentage method to determine federal withholding tax. The percentage method does not require the several pages of tables needed with the wage bracket method and is more easily adapted to computer applications in the processing of payrolls.

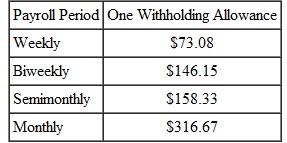

Percentage Method: Amount for One Withholding Allowanc e

OBJECTIVE Find the federal withholding tax using the wage bracket method. The Internal Revenue Service supplies withholding tax tables to be used with the wage bracket method. These tables are extensive, covering weekly, biweekly, semimonthly, monthly, and daily pay periods. Samples of the withholding tables are shown on this page and the next page.

OBJECTIVE Find the federal withholding tax using the percentage method. Many companies today prefer to use the percentage method to determine federal withholding tax. The percentage method does not require the several pages of tables needed with the wage bracket method and is more easily adapted to computer applications in the processing of payrolls.

Percentage Method: Amount for One Withholding Allowanc e

التوضيح

From an employer's point of view, it wou...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255