Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

النسخة 12الرقم المعياري الدولي: 978-0132605540

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

النسخة 12الرقم المعياري الدولي: 978-0132605540 تمرين 76

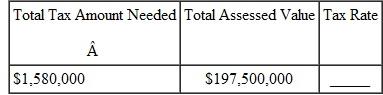

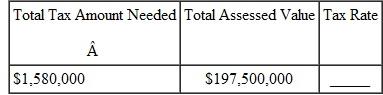

Find the tax rate for the following. Write the tax rate as a percent, rounded to the nearest tenth of a percent. (See Example.)

Finding the Tax Rate

Find the tax rate for the following school districts, rounded to the nearest hundredth of a percent.

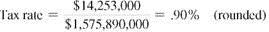

(a) Amount needed = $14,253,000; total assessed value = $1,575,890,000

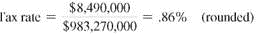

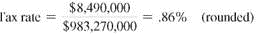

(b) Amount needed = $8,490,000; total assessed value = $983,270,000

SOLUTION

(a)

(b)

Finding the Tax Rate

Find the tax rate for the following school districts, rounded to the nearest hundredth of a percent.

(a) Amount needed = $14,253,000; total assessed value = $1,575,890,000

(b) Amount needed = $8,490,000; total assessed value = $983,270,000

SOLUTION

(a)

(b)

التوضيح

Recall the formula, ...

Business Mathematics Brief 12th Edition by Stanley Salzman ,Gary Clendenen, Charles Miller

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255