Economics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0073511498

Economics 1st Edition by Dean Karlan,Jonathan Morduch

النسخة 1الرقم المعياري الدولي: 978-0073511498 تمرين 6

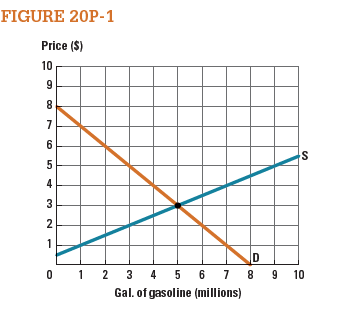

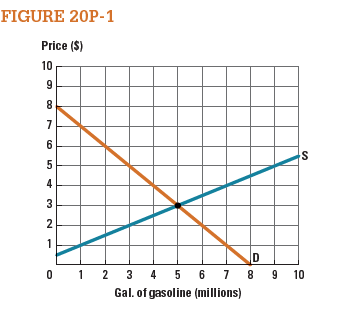

Figure 20P-1 shows a hypothetical market for gasoline.

A) Suppose an excise tax of $1.50 per gallon is levied on gasoline. What price will consumers pay? What price will sellers receive?

B) How much government revenue will result from the tax?

C) Suppose the tax is raised to $3 per gallon. How much additional revenue will this raise compared to the $1.50 tax?

D) Would raising the tax further to $4.50 per gallon increase or decrease tax revenue?

A) Suppose an excise tax of $1.50 per gallon is levied on gasoline. What price will consumers pay? What price will sellers receive?

B) How much government revenue will result from the tax?

C) Suppose the tax is raised to $3 per gallon. How much additional revenue will this raise compared to the $1.50 tax?

D) Would raising the tax further to $4.50 per gallon increase or decrease tax revenue?

التوضيح

Figure -1 illustrates the impact of $1.5...

Economics 1st Edition by Dean Karlan,Jonathan Morduch

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255