Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1285743615

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

النسخة 26الرقم المعياري الدولي: 978-1285743615 تمرين 28

Profitability ratios

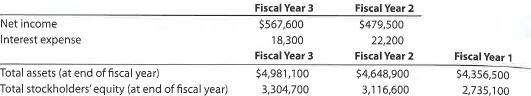

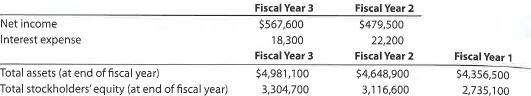

Ralph Lauren Corp. sells men's apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (all numbers in thousands):

Assume the apparel industry average rate earned on total assets is 8.0%, and the average rate earned on stockholders' equity is 10.0% for the year ended April 2, Year 3.

a. Determine the rate earned on total assets for Ralph Lauren for fiscal Years 2 and 3. Round to one digit after the decimal place.

b. Determine the rate earned on stockholders' equity for Ralph Lauren for fiscal Years 2 and 3. Round to one decimal place.

c. Evaluate the two-year trend for the profitability ratios determined in (a) and (b).

d. Evaluate Ralph Lauren's profit performance relative to the industry.

Ralph Lauren Corp. sells men's apparel through company-owned retail stores. Recent financial information for Ralph Lauren follows (all numbers in thousands):

Assume the apparel industry average rate earned on total assets is 8.0%, and the average rate earned on stockholders' equity is 10.0% for the year ended April 2, Year 3.

a. Determine the rate earned on total assets for Ralph Lauren for fiscal Years 2 and 3. Round to one digit after the decimal place.

b. Determine the rate earned on stockholders' equity for Ralph Lauren for fiscal Years 2 and 3. Round to one decimal place.

c. Evaluate the two-year trend for the profitability ratios determined in (a) and (b).

d. Evaluate Ralph Lauren's profit performance relative to the industry.

التوضيح

Profitability analysis

Profitability ana...

Accounting 26th Edition by Carl Warren,James Reeve,Jonathan Duchac

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255