Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 15

COST OF GOODS MANUFACTURED

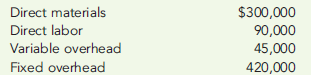

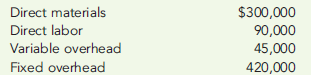

Refer to Cornerstone Exercise 2-1. For next year, Sodowsky predicts that 150,000 units will be produced, with the following total costs:

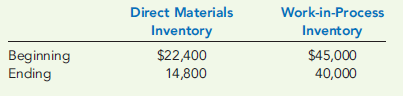

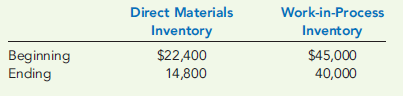

Next year, Sodowsky expects to purchase $292,400 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows:

Required:

1. Prepare a statement of cost of goods manufactured in good form.

2. What if the ending inventory of direct materials increased by $2,000? Which line items on the statement of cost of goods manufactured would be affected and in what direction (increase or decrease)?

Refer to Cornerstone Exercise 2-1. For next year, Sodowsky predicts that 150,000 units will be produced, with the following total costs:

Next year, Sodowsky expects to purchase $292,400 of direct materials. Projected beginning and ending inventories for direct materials and work in process are as follows:

Required:

1. Prepare a statement of cost of goods manufactured in good form.

2. What if the ending inventory of direct materials increased by $2,000? Which line items on the statement of cost of goods manufactured would be affected and in what direction (increase or decrease)?

التوضيح

1.

Prepare a statement of cost of goods...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255