Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 3

CASH BUDGET

Bruce ''Bruiser'' Hawkins, former all-state high school wrestler, owns a retail store that sells new and used sporting equipment. Bruiser has requested a cash budget for October. After examining the records of the company, you find the following:

a. Cash balance on October 1 is $1,118.

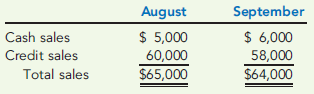

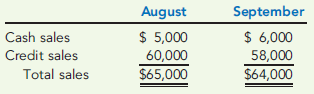

b. Actual sales for August and September are as follows:

c. Credit sales are collected over a three-month period: 35 percent in the month of sale, 45 percent in the next month, and 16 percent in the second month after the sale. The remaining sales are uncollectible.

d. Inventory purchases average 70 percent of a month's total sales. Of those purchases, 40 percent are paid for in the month of purchase. The remaining 60 percent are paid for in the following month.

e. Salaries and wages total $4,200 per month.

f. Rent is $2,400 per month.

g. Taxes to be paid in October are $965.

h. Bruiser usually withdraws $3,500 each month as his salary.

i. Advertising is $500 per month.

j. Other operating expenses total $3,800 per month.

k. Internet and telephone fees are $320 per month.

Bruiser tells you that he expects cash sales of $6,500 and credit sales of $55,000 for October. He likes to have $3,000 on hand at the end of the month and is concerned about the potential October ending balance.

Required:

1. Prepare a cash budget for October. Include supporting schedules for cash collections and cash payments.

2. Did the business meet Bruiser's desired ending cash balance for October? Assuming that the owner has no hope of establishing a line of credit for the business, what recommendations would you give the owner for meeting the desired cash balance?

Bruce ''Bruiser'' Hawkins, former all-state high school wrestler, owns a retail store that sells new and used sporting equipment. Bruiser has requested a cash budget for October. After examining the records of the company, you find the following:

a. Cash balance on October 1 is $1,118.

b. Actual sales for August and September are as follows:

c. Credit sales are collected over a three-month period: 35 percent in the month of sale, 45 percent in the next month, and 16 percent in the second month after the sale. The remaining sales are uncollectible.

d. Inventory purchases average 70 percent of a month's total sales. Of those purchases, 40 percent are paid for in the month of purchase. The remaining 60 percent are paid for in the following month.

e. Salaries and wages total $4,200 per month.

f. Rent is $2,400 per month.

g. Taxes to be paid in October are $965.

h. Bruiser usually withdraws $3,500 each month as his salary.

i. Advertising is $500 per month.

j. Other operating expenses total $3,800 per month.

k. Internet and telephone fees are $320 per month.

Bruiser tells you that he expects cash sales of $6,500 and credit sales of $55,000 for October. He likes to have $3,000 on hand at the end of the month and is concerned about the potential October ending balance.

Required:

1. Prepare a cash budget for October. Include supporting schedules for cash collections and cash payments.

2. Did the business meet Bruiser's desired ending cash balance for October? Assuming that the owner has no hope of establishing a line of credit for the business, what recommendations would you give the owner for meeting the desired cash balance?

التوضيح

1.

Prepare the cash budget for the mont...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255