Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 35

CLOSING THE BALANCES IN THE VARIANCE ACCOUNTS AT THE END OF THE YEAR

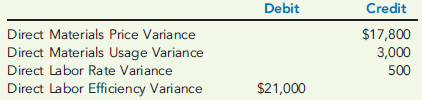

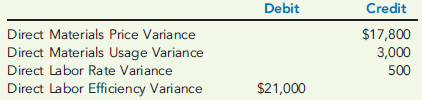

Baxter Company has the following balances in its direct materials and direct labor variance accounts at year-end:

Unadjusted Cost of Goods Sold equals $560,000, unadjusted Work in Process equals $175,000, and unadjusted Finished Goods equals $80,000.

Required:

1. Assume that the ending balances in the variance accounts are immaterial and prepare the journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances?

2. What if any ending balance in a variance account that exceeds $10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods. The prime cost in Cost of Goods Sold is $400,000, the prime cost in Work in Process is $125,000, and the prime cost in Finished Goods is $56,800. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances?

Baxter Company has the following balances in its direct materials and direct labor variance accounts at year-end:

Unadjusted Cost of Goods Sold equals $560,000, unadjusted Work in Process equals $175,000, and unadjusted Finished Goods equals $80,000.

Required:

1. Assume that the ending balances in the variance accounts are immaterial and prepare the journal entries to close them to Cost of Goods Sold. What is the adjusted balance in Cost of Goods Sold after closing out the variances?

2. What if any ending balance in a variance account that exceeds $10,000 is considered material? Close the immaterial variance accounts to Cost of Goods Sold and prorate the material variances among Cost of Goods Sold, Work in Process, and Finished Goods. The prime cost in Cost of Goods Sold is $400,000, the prime cost in Work in Process is $125,000, and the prime cost in Finished Goods is $56,800. What are the adjusted balances in Work in Process, Finished Goods, and Cost of Goods Sold after closing out all variances?

التوضيح

1. Journal entries:

Adjusted cost of ...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255