Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 15

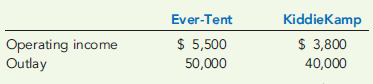

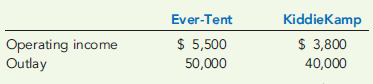

ROI AND INVESTMENT DECISIONS

Refer to Exercise 10-7 for data. At the end of Year 2, the manager of the Camping Division is concerned about the division's performance. As a result, he is considering the opportunity to invest in two independent projects. The first is called the ''Ever-Tent''; it is a small two-person tent capable of withstanding the high winds at the top of Mt. Everest. While the market for actual Everest climbers is small, the manager expects that well-todo weekend campers will buy it due to the cachet of the name and its light weight. The second is a ''KiddieKamp'' kit which includes a child-sized sleeping bag and a colourful pup tent that can be set up easily in one's backyard. Without the investments, the division expects that Year 2 data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows:

Selfridge's corporate headquarters has made available up to $100,000 of capital for this division. Any funds not invested by the division will be retained by headquarters and invested to earn the company's minimum required rate of return, 9 percent.

Required:

1. Compute the ROI for each investment.

2. Compute the divisional ROI (rounded to four significant digits) for each of the following four alternatives:

a. The Ever-Tent is added.

b. The KiddieKamp is added.

c. Both investments are added.

d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose?

Refer to Exercise 10-7 for data. At the end of Year 2, the manager of the Camping Division is concerned about the division's performance. As a result, he is considering the opportunity to invest in two independent projects. The first is called the ''Ever-Tent''; it is a small two-person tent capable of withstanding the high winds at the top of Mt. Everest. While the market for actual Everest climbers is small, the manager expects that well-todo weekend campers will buy it due to the cachet of the name and its light weight. The second is a ''KiddieKamp'' kit which includes a child-sized sleeping bag and a colourful pup tent that can be set up easily in one's backyard. Without the investments, the division expects that Year 2 data will remain unchanged. The expected operating incomes and the outlay required for each investment are as follows:

Selfridge's corporate headquarters has made available up to $100,000 of capital for this division. Any funds not invested by the division will be retained by headquarters and invested to earn the company's minimum required rate of return, 9 percent.

Required:

1. Compute the ROI for each investment.

2. Compute the divisional ROI (rounded to four significant digits) for each of the following four alternatives:

a. The Ever-Tent is added.

b. The KiddieKamp is added.

c. Both investments are added.

d. Neither investment is made; the status quo is maintained. Assuming that divisional managers are evaluated and rewarded on the basis of ROI performance, which alternative do you think the divisional manager will choose?

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255