Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 33

OPERATING INCOME FOR SEGMENTS

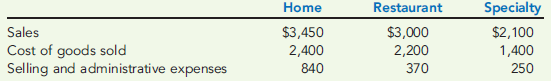

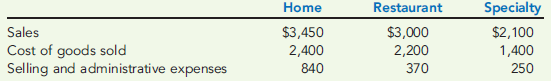

Venpool, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands):

The income tax rate for Venpool, Inc., is 30 percent. Venpool, Inc., has two sources of financing: bonds paying 6 percent interest, which account for 30 percent of total investment, and equity accounting for the remaining 70 percent of total investment. Venpool, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Venpool stock has an opportunity cost of 5 percent over the 6 percent long-term government bond rate. Venpool's total capital employed is $3.34 million ($2,100,000 for the Home Division, $700,000 for the Restaurant Division, and the remainder for the Specialty Division).

Required:

1. Prepare a segmented income statement for Venpool, Inc., for last year.

2. Calculate Venpool's weighted average cost of capital. (Round to four significant digits.)

3. Calculate EVA for each division and for Venpool, Inc.

4. Comment on the performance of each of the divisions.

Venpool, Inc., manufactures and sells cooktops and ovens through three divisions: Home, Restaurant, and Specialty. Each division is evaluated as a profit center. Data for each division for last year are as follows (numbers in thousands):

The income tax rate for Venpool, Inc., is 30 percent. Venpool, Inc., has two sources of financing: bonds paying 6 percent interest, which account for 30 percent of total investment, and equity accounting for the remaining 70 percent of total investment. Venpool, Inc., has been in business for over 15 years and is considered a relatively stable stock, despite its link to the cyclical construction industry. As a result, Venpool stock has an opportunity cost of 5 percent over the 6 percent long-term government bond rate. Venpool's total capital employed is $3.34 million ($2,100,000 for the Home Division, $700,000 for the Restaurant Division, and the remainder for the Specialty Division).

Required:

1. Prepare a segmented income statement for Venpool, Inc., for last year.

2. Calculate Venpool's weighted average cost of capital. (Round to four significant digits.)

3. Calculate EVA for each division and for Venpool, Inc.

4. Comment on the performance of each of the divisions.

التوضيح

1.

Segment income statement for V, Inc....

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255