Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 28

DISTRIBUTION OF QUALITY COSTS

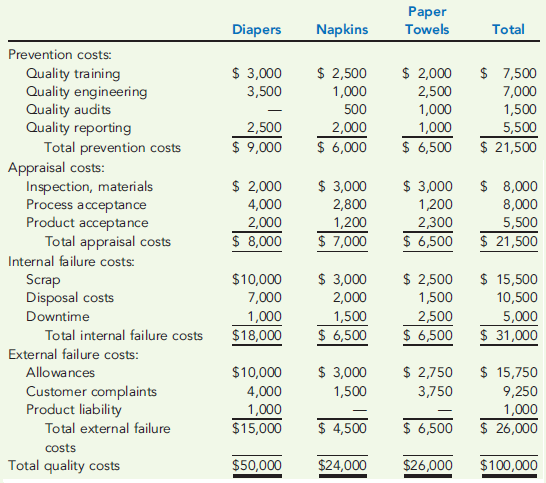

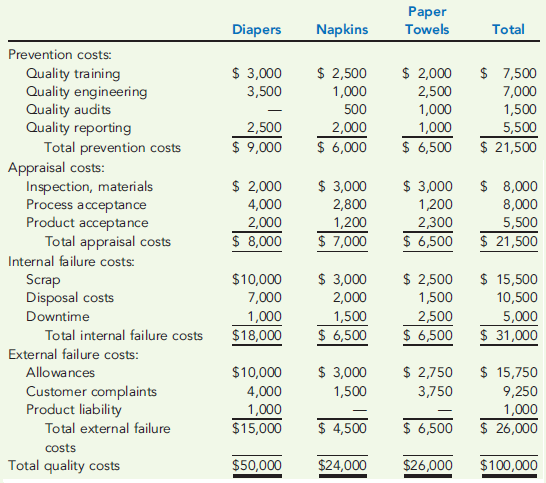

Paper Products Division produces paper diapers, napkins, and paper towels. The divisional manager has decided that quality costs can be minimized by distributing quality costs evenly among the four quality categories and reducing them to no more than 5 percent of sales. He has just received the following quality cost report:

Paper Products Division Quality Cost Report For the Year Ended December 31, 2011

Assume that all prevention costs are fixed and that the remaining quality costs are variable (unit-level).

Required:

1. Assume that the sales revenue for the year totaled $2 million, with sales for each product as follows: diapers, $1 million; napkins, $600,000; paper towels, $400,000. Evaluate the distribution of costs for the division as a whole and for each product line. What recommendations do you have for the divisional manager?

2. Now, assume that total sales are $1 million and have this breakdown: diapers, $500,000; napkins, $300,000; paper towels, $200,000. Evaluate the distribution of costs for the division as a whole and for each product line in this case. Do you think it is possible to reduce the quality costs to 5 percent of sales for each product line and for the division as a whole and, simultaneously, achieve an equal distribution of the quality costs? What recommendations do you have?

3. Assume total sales of $1 million with this breakdown: diapers, $500,000; napkins, $180,000; paper towels, $320,000. Evaluate the distribution of quality costs. What recommendations do you have for the divisional manager?

4. Discuss the value of having quality costs reported by segment.

Paper Products Division produces paper diapers, napkins, and paper towels. The divisional manager has decided that quality costs can be minimized by distributing quality costs evenly among the four quality categories and reducing them to no more than 5 percent of sales. He has just received the following quality cost report:

Paper Products Division Quality Cost Report For the Year Ended December 31, 2011

Assume that all prevention costs are fixed and that the remaining quality costs are variable (unit-level).

Required:

1. Assume that the sales revenue for the year totaled $2 million, with sales for each product as follows: diapers, $1 million; napkins, $600,000; paper towels, $400,000. Evaluate the distribution of costs for the division as a whole and for each product line. What recommendations do you have for the divisional manager?

2. Now, assume that total sales are $1 million and have this breakdown: diapers, $500,000; napkins, $300,000; paper towels, $200,000. Evaluate the distribution of costs for the division as a whole and for each product line in this case. Do you think it is possible to reduce the quality costs to 5 percent of sales for each product line and for the division as a whole and, simultaneously, achieve an equal distribution of the quality costs? What recommendations do you have?

3. Assume total sales of $1 million with this breakdown: diapers, $500,000; napkins, $180,000; paper towels, $320,000. Evaluate the distribution of quality costs. What recommendations do you have for the divisional manager?

4. Discuss the value of having quality costs reported by segment.

التوضيح

1.

Evaluate distribution of costs for t...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255