Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 22

MULTIPLE-PRODUCT BREAK-EVEN AND TARGET PROFIT

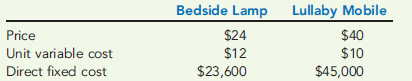

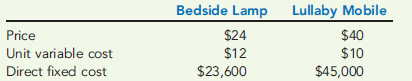

Sandman Enterprises produces and sells two products: a bedside lamp decorated with comic book characters, and a baby mobile that hangs above a crib and can play lullabies. Sandman plans to sell 30,000 bedside lamps and 20,000 lullaby mobiles in the coming year. Product price and cost information includes:

Common fixed selling and administrative expense totals $85,000.

Required:

1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?

2. Using the sales mix from Requirement 1, form a package of bedside lamps and lullaby mobiles. How many bedside lamps and lullaby mobiles are sold at break-even?

3. Prepare a contribution-margin-based income statement for Sandman Enterprises based on the unit sales calculated in Requirement 2.

4. What if Sandman Enterprises wanted to earn operating income equal to $14,400? Calculate the number of bedside lamps and lullaby mobiles that must be sold to earn this level of operating income. (Hint: Remember to form a package of bedside lamps and lullaby mobiles based on the sales mix and to first calculate the number of packages to earn operating income of $14,400.)

Sandman Enterprises produces and sells two products: a bedside lamp decorated with comic book characters, and a baby mobile that hangs above a crib and can play lullabies. Sandman plans to sell 30,000 bedside lamps and 20,000 lullaby mobiles in the coming year. Product price and cost information includes:

Common fixed selling and administrative expense totals $85,000.

Required:

1. What is the sales mix estimated for next year (calculated to the lowest whole number for each product)?

2. Using the sales mix from Requirement 1, form a package of bedside lamps and lullaby mobiles. How many bedside lamps and lullaby mobiles are sold at break-even?

3. Prepare a contribution-margin-based income statement for Sandman Enterprises based on the unit sales calculated in Requirement 2.

4. What if Sandman Enterprises wanted to earn operating income equal to $14,400? Calculate the number of bedside lamps and lullaby mobiles that must be sold to earn this level of operating income. (Hint: Remember to form a package of bedside lamps and lullaby mobiles based on the sales mix and to first calculate the number of packages to earn operating income of $14,400.)

التوضيح

1.

Sales mix expected for next year:

B...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255