Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 13

KEEP-OR-DROP DECISION, ALTERNATIVES, RELEVANT COSTS

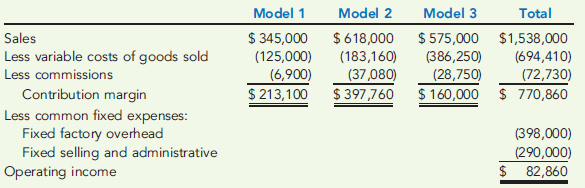

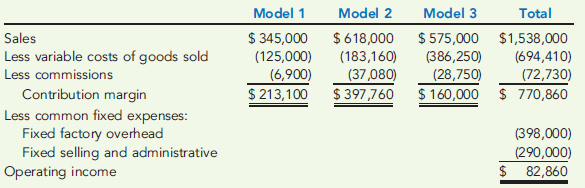

Ambi Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dry and wet vacuuming capabilities. Model 3 is the heavy duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below.

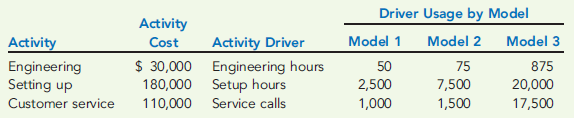

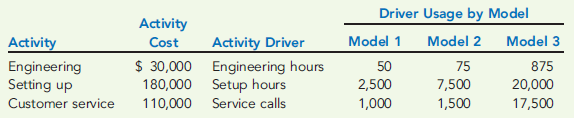

While all models have positive contribution margins, Ambi Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered:

In addition, Model 3 requires the rental of specialized equipment costing $20,000 per year.

Required:

1. Reformulate the segmented income statement using the additional information on activities.

2. Using your answer to Requirement 1, assume that Ambi Company is considering dropping any model with a negative product margin. What are the alternatives? Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.)

3. What if Ambi Company can only avoid 375 hours of engineering time and 10,000 hours of setup time that are attributable to Model 3? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much?

Ambi Company makes three types of rug shampooers. Model 1 is the basic model rented through hardware stores and supermarkets. Model 2 is a more advanced model with both dry and wet vacuuming capabilities. Model 3 is the heavy duty riding shampooer sold to hotels and convention centers. A segmented income statement is shown below.

While all models have positive contribution margins, Ambi Company is concerned because operating income is less than 10 percent of sales and is low for this type of company. The company's controller gathered additional information on fixed costs to see why they were so high. The following information on activities and drivers was gathered:

In addition, Model 3 requires the rental of specialized equipment costing $20,000 per year.

Required:

1. Reformulate the segmented income statement using the additional information on activities.

2. Using your answer to Requirement 1, assume that Ambi Company is considering dropping any model with a negative product margin. What are the alternatives? Which alternative is more cost effective and by how much? (Assume that any traceable fixed costs can be avoided.)

3. What if Ambi Company can only avoid 375 hours of engineering time and 10,000 hours of setup time that are attributable to Model 3? How does that affect the alternatives presented in Requirement 2? Which alternative is more cost effective and by how much?

التوضيح

1. Reformulated Segmented income stateme...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255