Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 29

KEEP-OR-DROP: TRADITIONAL VERSUS ACTIVITY-BASED ANALYSIS

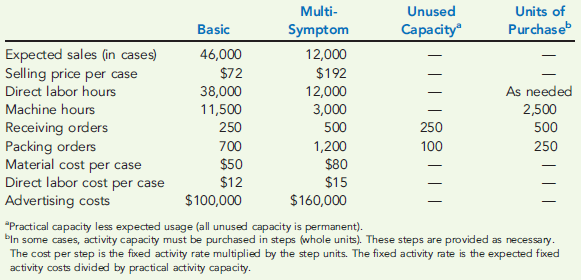

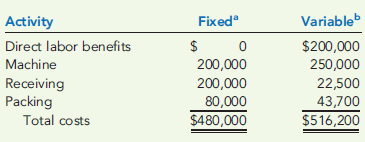

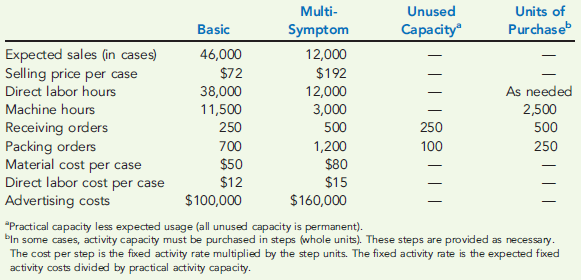

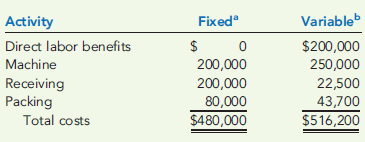

Harding, Inc., produces two types of cough syrup: Basic and Multi-Symptom. Of the two, Basic is the more popular. Data concerning the two products follow:

Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver.

Required:

1. Prepare a traditional segmented income statement, using a unit-level overhead rate based on direct labor hours. Using this approach, determine whether the Basic cough syrup product line should be kept or dropped.

2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysis using an ABC approach.

Harding, Inc., produces two types of cough syrup: Basic and Multi-Symptom. Of the two, Basic is the more popular. Data concerning the two products follow:

Annual overhead costs are listed below. These costs are classified as fixed or variable with respect to the appropriate activity driver.

Required:

1. Prepare a traditional segmented income statement, using a unit-level overhead rate based on direct labor hours. Using this approach, determine whether the Basic cough syrup product line should be kept or dropped.

2. Prepare an activity-based segmented income statement. Repeat the keep-or-drop analysis using an ABC approach.

التوضيح

هذا السؤال ليس له إجابة موثقة من أحد الخبراء بعد، دع الذكاء الاصطناعي Copilot في كويز بلس يساعدك في إيجاد الحل.

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255