Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

النسخة 1الرقم المعياري الدولي: 978-0538736787 تمرين 38

ABSORPTION AND VARIABLE COSTING WITH OVER- AND UNDERAPPLIED OVERHEAD

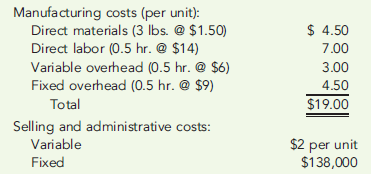

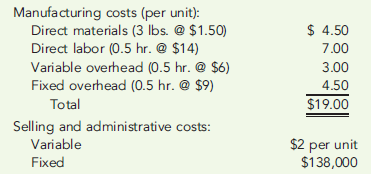

Wellington, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows:

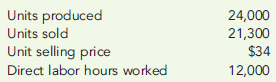

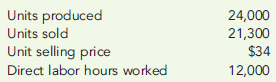

During the year, the company had the following activity:

Actual fixed overhead was $12,000 less than budgeted fixed overhead. Budgeted variable overhead was $5,000 less than the actual variable overhead. The company used an expected actual activity level of 24,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold.

Required:

1. Compute the unit cost using (a) absorption costing and (b) variable costing.

2. Prepare an absorption-costing income statement.

3. Prepare a variable-costing income statement.

4. Reconcile the difference between the two income statements.

Wellington, Inc., has just completed its first year of operations. The unit costs on a normal costing basis are as follows:

During the year, the company had the following activity:

Actual fixed overhead was $12,000 less than budgeted fixed overhead. Budgeted variable overhead was $5,000 less than the actual variable overhead. The company used an expected actual activity level of 24,000 direct labor hours to compute the predetermined overhead rates. Any overhead variances are closed to Cost of Goods Sold.

Required:

1. Compute the unit cost using (a) absorption costing and (b) variable costing.

2. Prepare an absorption-costing income statement.

3. Prepare a variable-costing income statement.

4. Reconcile the difference between the two income statements.

التوضيح

1)

Calculate unit cost using absorption...

Cornerstones of Cost Accounting 1st Edition by Don Hansen,Maryanne Mowen

لماذا لم يعجبك هذا التمرين؟

أخرى 8 أحرف كحد أدنى و 255 حرفاً كحد أقصى

حرف 255